TV presenter Kirstie Allsopp recently provoked debate by suggesting that young people can afford to buy their own home by cutting back on spending, saving while they lived with their parents, and moving to a cheaper area. Is it that easy?

One good measure of housing affordability is to look at average house prices relative to the average wages in an area. The higher the ratio of house price to wages the more difficulty it is for someone to afford a house. Since the 1990s the ratio in the UK has been on an upward trend rising from around 4 to above 8. Buying a house has, therefore, become more difficult for younger people than their parents and grandparents. Part of the debate, however, has been around young people moving to where houses are cheaper. So, how does this argument stack up when we look at the East Midlands?

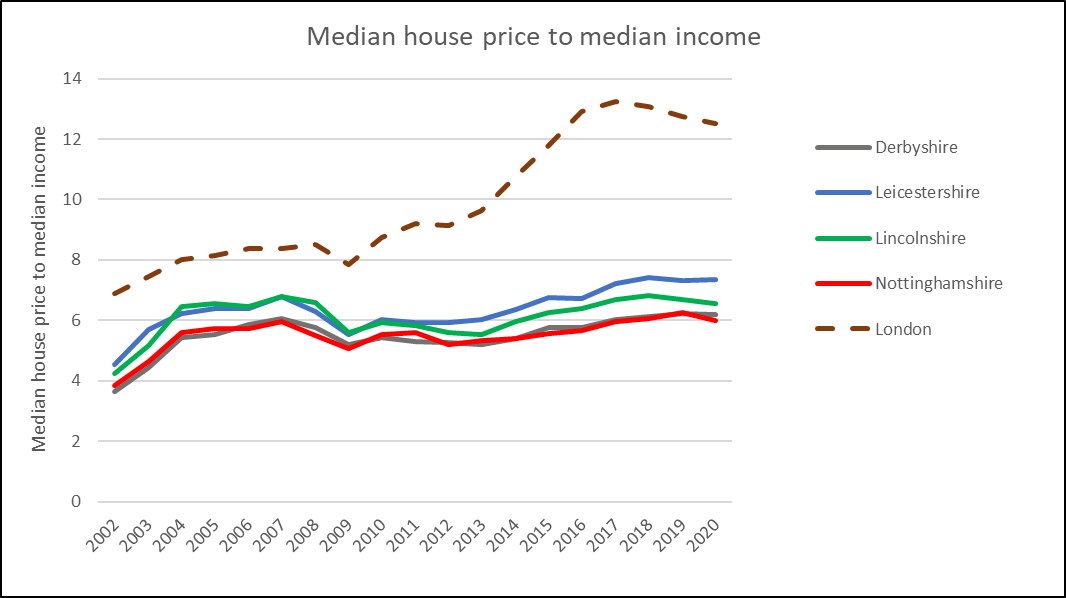

The ONS provide consistent, reliable data at a regional level from 2002. Our first chart below details the ratio of house price to income for counties in the East Midlands between 2002 and 2020. For comparison we put that of London. While house prices dipped during the financial crisis of 2009, and lag well behind those of London, the overall picture in the East Midlands is still one of rising relative house prices. The ratio seems particularly high in Leicestershire at 7.35 in 2020, compared to 4.55 in 2002. Houses have, therefore, become less affordable in the East Midlands.

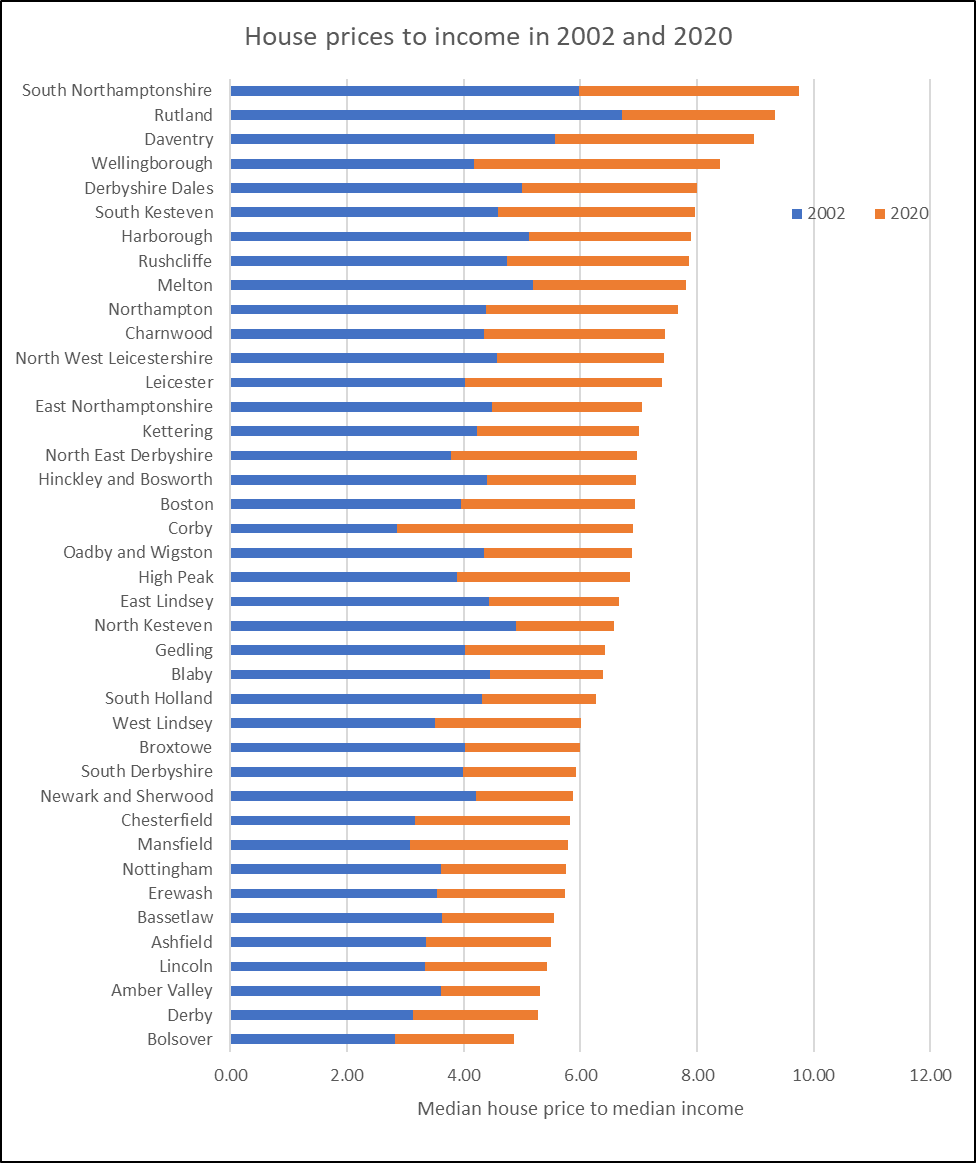

Our second chart breaks down the ratio and change since 2002 by local authority area. In interpretation, South Northamptonshire and Rutland have the ‘least affordable’ housing and Derby and Bolsover the ‘most affordable’ for local residents. It is worth noting that regional variation reflects differences in both incomes and house prices. For instance, Derby has a low ratio primarily because of relatively high wages (median wage around £31k and house price £177k) while Nottingham has a lower ratio because of low houser prices (median wage around £25k and house price £162k). Leicester, by contrast, has relatively low wages and high house prices (median wage of £25k and house price £201k).

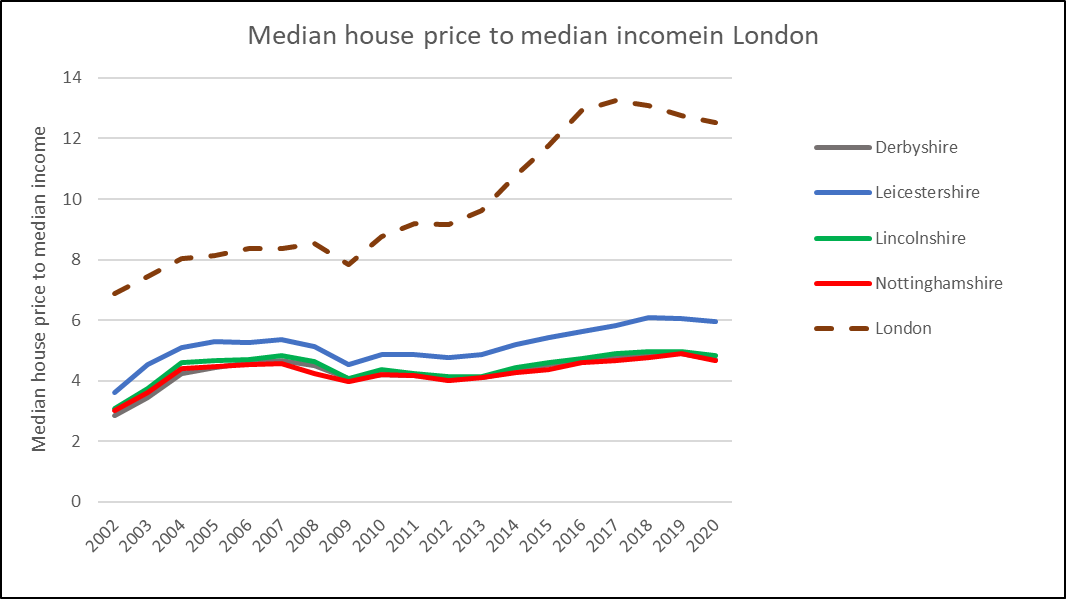

Part of the debate has been around commuting. Let us, therefore, consider the options for someone living in the East Midlands and commuting to London. Ignoring the question of whether that is a good thing for the East Midlands economy, we can see what it does to housing affordability. The chart below plots the ratio for someone living in the East Midlands and earning London wages. Even here the ratio stays well above 4 and reaches 6 in Leicestershire. And, of course, we would need to take into accounting commuting costs, both financially and time. Moving out of London does not, therefore, solve the problem.

In summary, house prices have gone up faster than income across the UK over the last 20 years. While house prices are spectacularly high in London, they have risen elsewhere, including in the East Midlands. This inevitably makes it much more difficult for younger generations to get on the housing ladder – even if they do scrap their Netflix subscription and live with their parents for a few years.